We also asked people to select the top phrases they would (like to) use to describe their lives across different ages.

Enjoyment is associated with every age group, although we observed the well-documented u-shaped curve of happiness, with ‘enjoyment’ as a descriptor dipping to its lowest point for people in their 40s. Freedom is more associated with later decades than choice, opportunity, discovery or control.

We found that younger people aged 18-29 expect their 30s to be a time of enjoyment and fulfilment, whereas those in their 30s describe it as a time of transition and taking control. We also found that 18-49 year olds expect their 50s to be a time of relaxation enjoyment and fulfilment, but those in their 50s describe it as a time of transitions, balance and taking control.

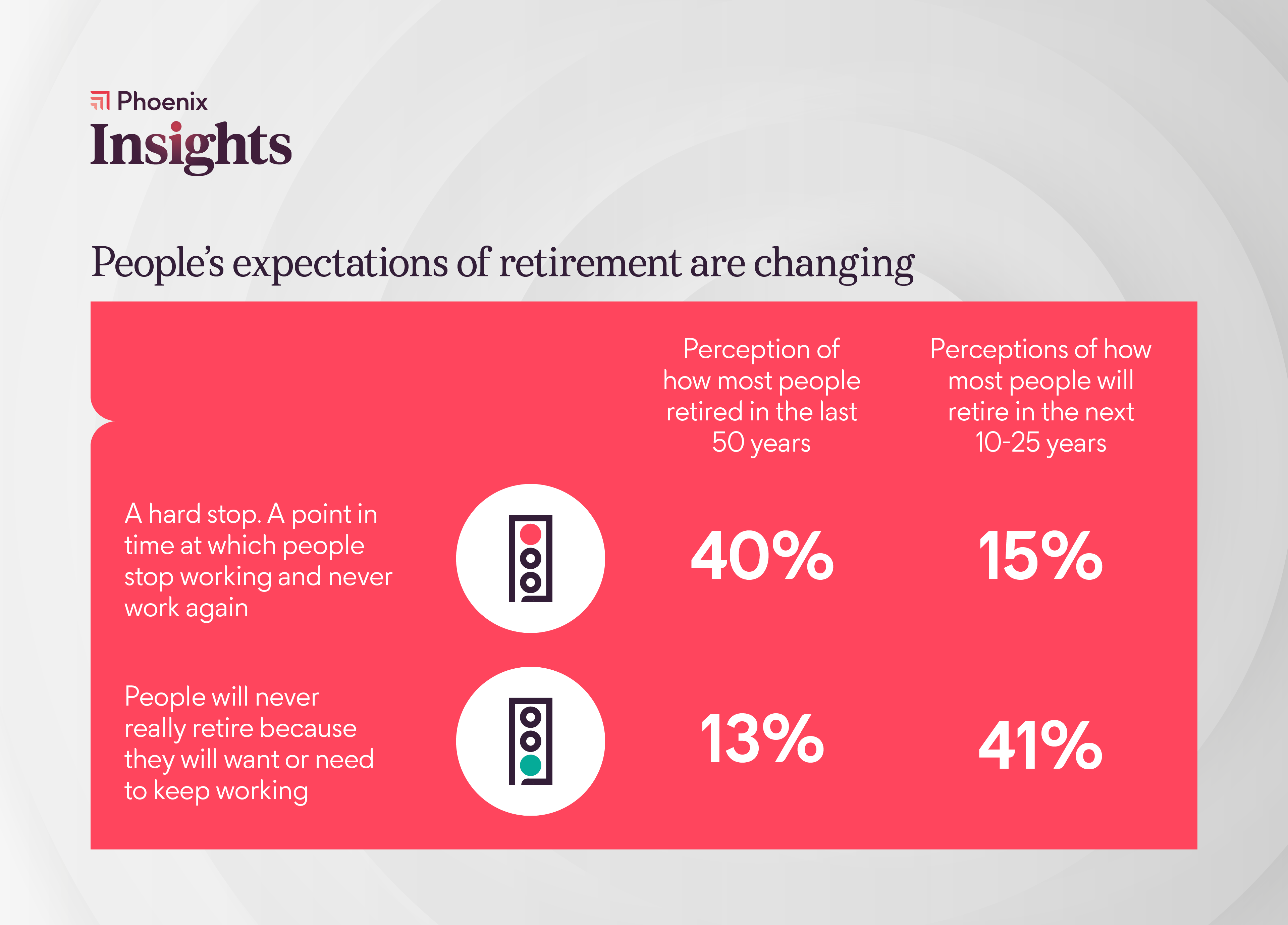

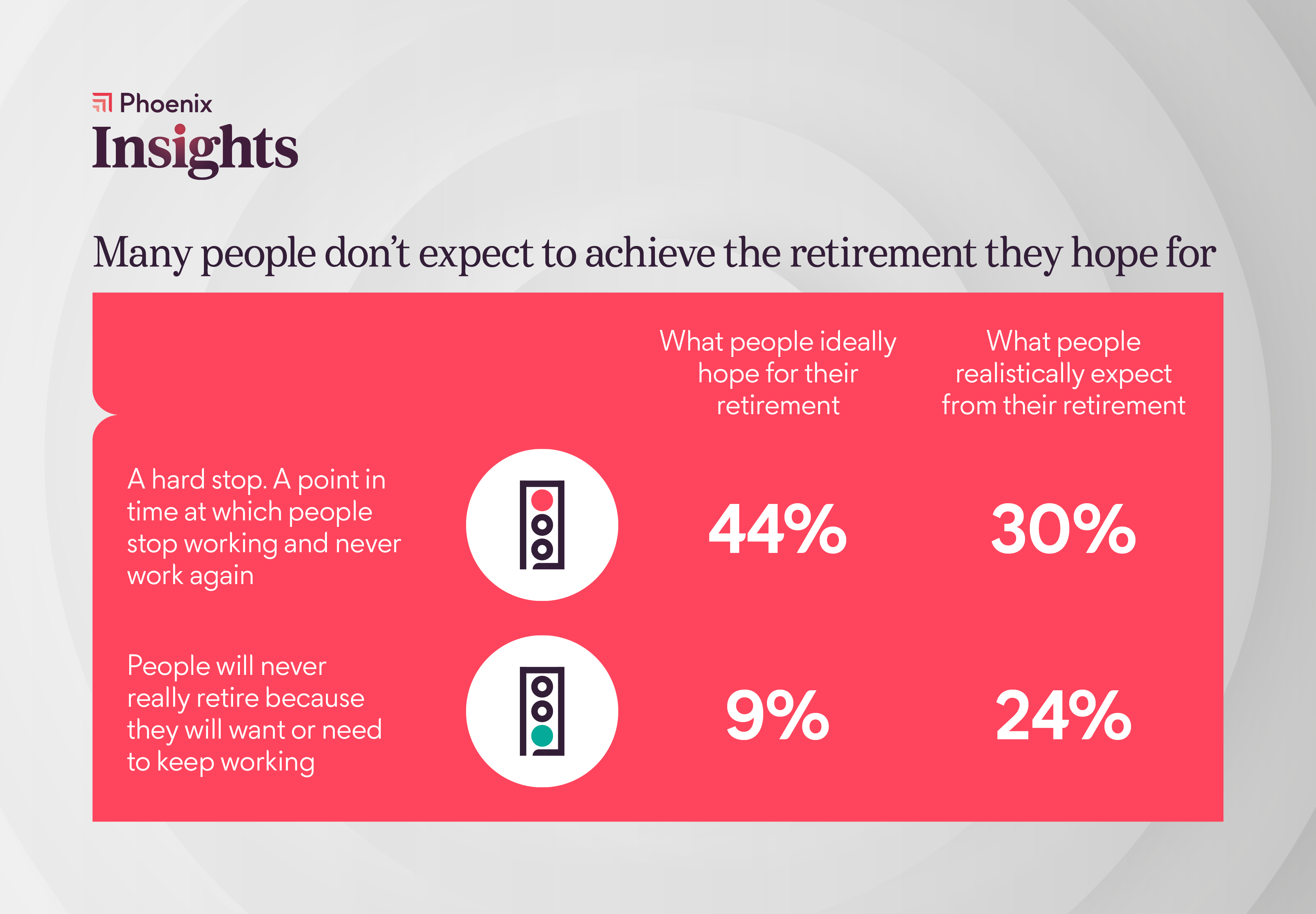

The research highlights that people are much less likely to anticipate transitions than to recognise them in the moment or in hindsight. This is important to understand because longer and more varied, flexible lives, are likely to mean we all experience more life events and will need to navigate more transitions. This all paints a picture of people’s changing hopes and expectations for work and retirement. It shows that many people struggle to visualise what their retirement will look like, and raises significant questions over what new, more or better help people need to manage their finances, health and careers over longer lives.

Some of what’s needed are structural changes – from growing access to good quality flexible work for example, to increasing awareness and access to careers support and advice for working adults, and development of new and different forms of financial advice and guidance. And much of what is needed is more cultural, changing our expectations of life’s milestones, of what people can or should do and when, including creating more and varied role models of the different shapes a modern and healthy retirement can take.