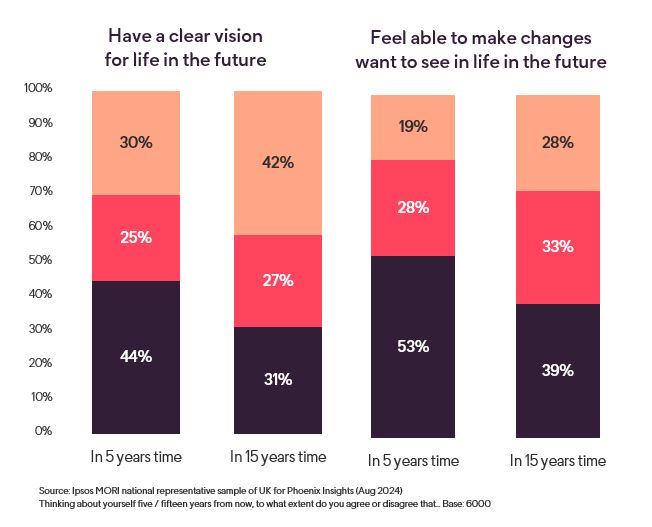

People reaching retirement today started out on their working and saving journey many decades before. But over time, the way we work, save and retire has been changing, and will continue to change in the future.

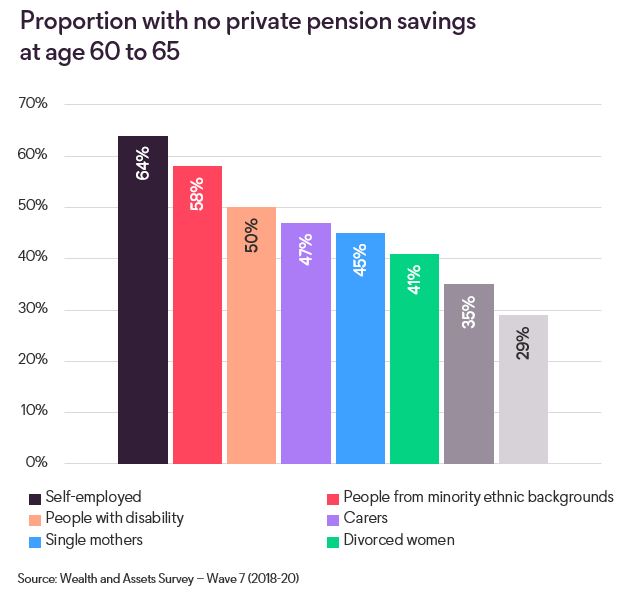

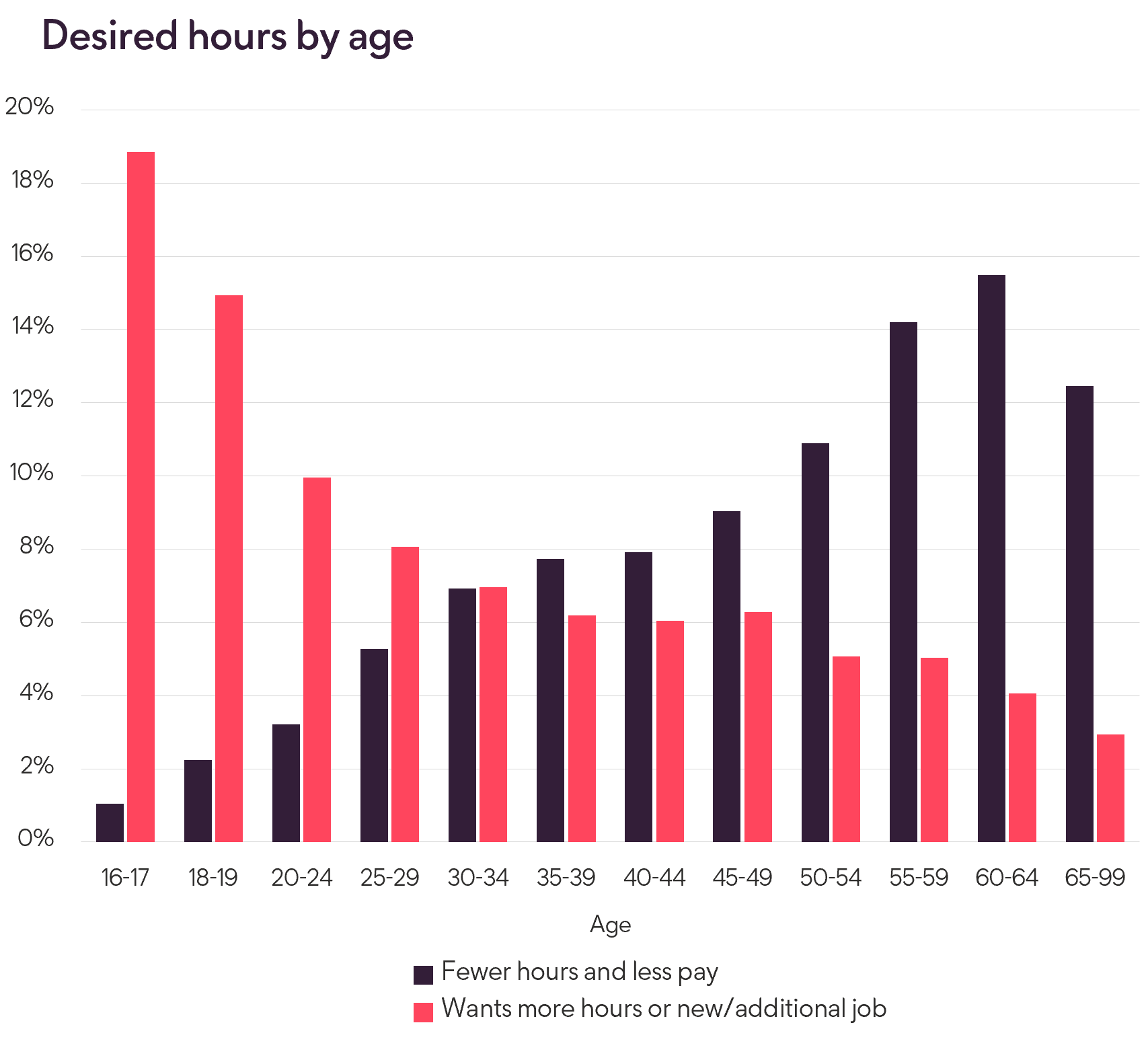

These changes are complex, with some groups in society benefiting and others facing greater risks. The decline of final salary pension schemes means workplace pensions are much less generous than they used to be. The introduction of automatic enrolment has brought millions more workers into regular pension saving, but at levels unlikely to meet their aspirations for retirement. On average, people are both entering and retiring from work later than they used to, but many who find themselves out of work as they get older find it hard to get back into employment.

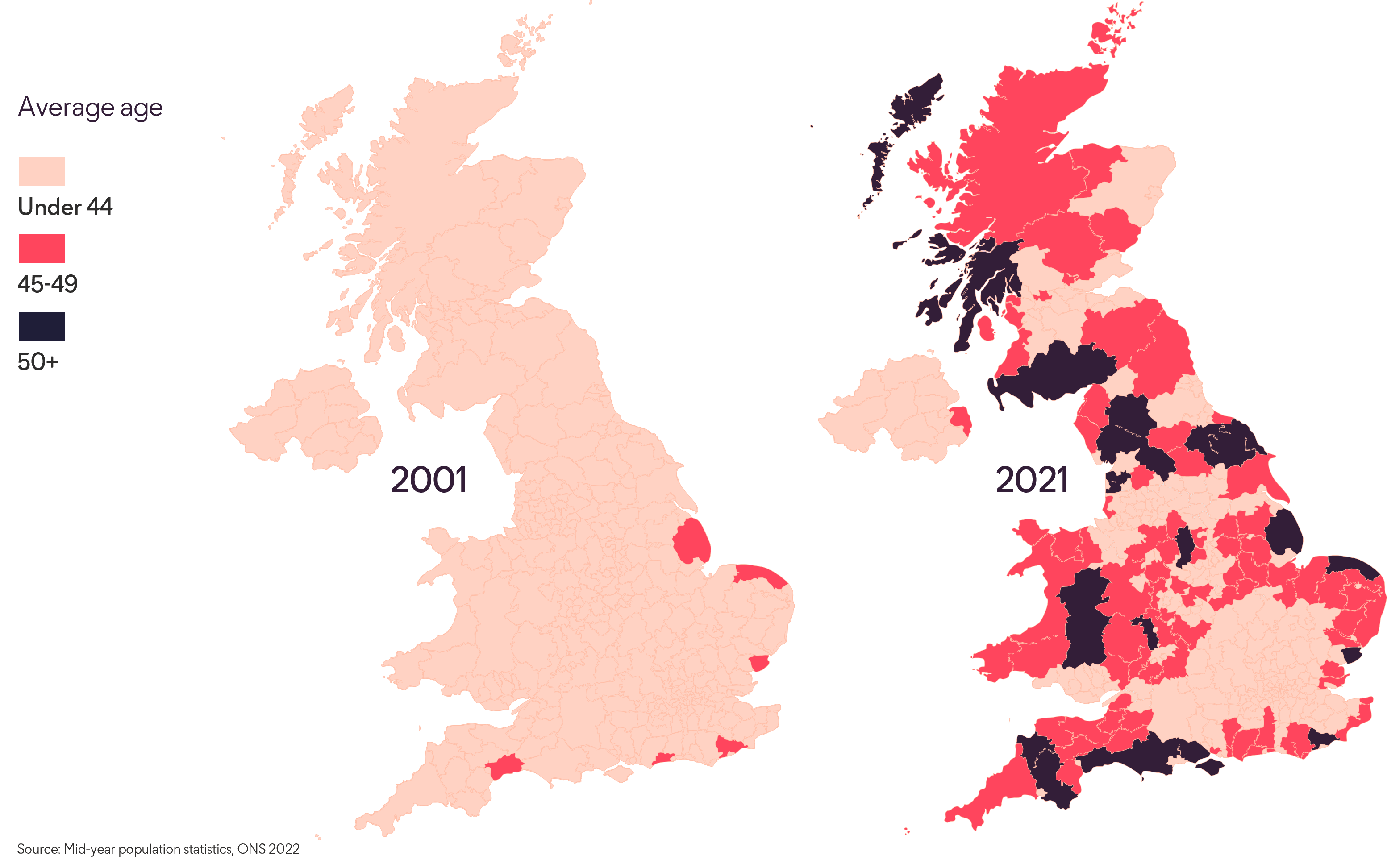

Our new research uses data to understand how demographic, societal, workplace and economic changes have all contributed to a markedly different landscape for people working, saving and retiring.