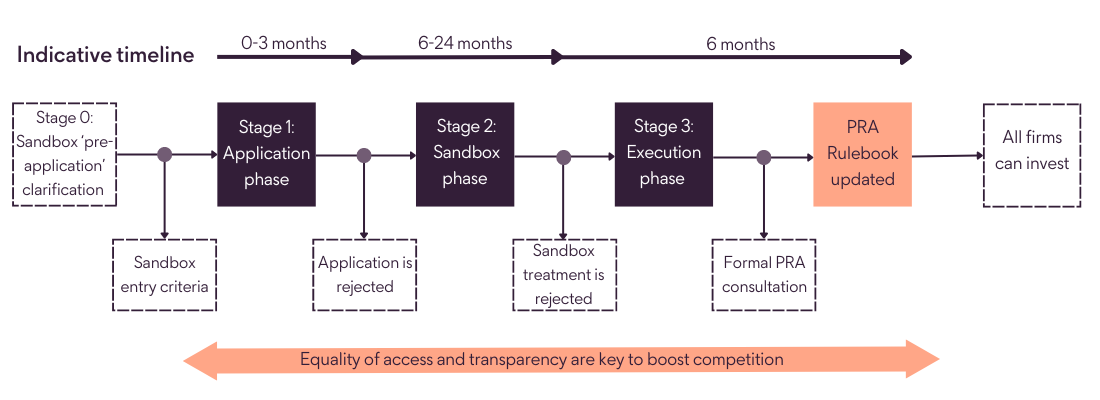

Stage 1: Firms could voluntarily apply to the PRA for a time-bound waiver to invest a limited amount in a specific asset which would ordinarily not be allowed in the MA fund. A temporary regulatory treatment for the asset would be agreed before the PRA accepts this application to enter the sandbox.

Stage 2: Once in the sandbox, the PRA would examine the asset in-depth, and engage with the firm on potential regulatory treatment of the asset. At the end of the sandbox phase, the PRA would publish the outcome of their investigation.

Stage 3: If successful, during the execution phase the PRA would consult on amended MA rules to allow the investment. Following the consultation, the PRA would publish revised rules to allow any MA fund to invest.