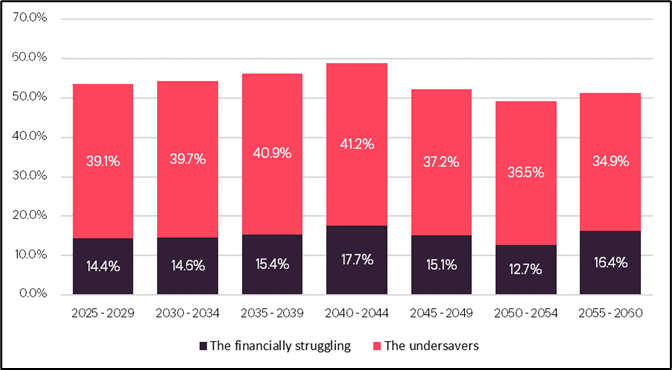

The years 2040 to 2044 represent a critical period, as it will see the highest number of “financially struggling” or “undersavers” reaching retirement (Figure 1). Three in five (59%) of all new DC savers retiring during this period will fall into these two categories of concern, equivalent to 2.67 million people.

The analysis finds this group are predominantly born in the 1970s, female, working full-time, earning below £80k (about half of them earn below £20k) and expecting to retire between the ages of 66 and 70.

Patrick Thomson, head of research analysis and policy at Phoenix Insights

“The analysis paints a bleak picture of future retirement incomes. We are already reaching the stage where the majority of people with a defined contribution pension will enter retirement with either less than they expect, or less than they need in terms of a minimum living standard. This situation is set to worsen over time and peak in the next 20 years.

“There is an urgent need to address undersaving to better support people achieve financial security later in life. Immediate policy interventions should include a plan to increase minimum auto-enrolment contribution rates when the economic conditions allow. And this should go hand-in-hand with policies to make work more sustainable and accessible for the over-60s, so people can continue to earn and save later in life.

“The plight of retirement incomes is clear to see, but we have a golden opportunity to take meaningful action to turn the tide in undersaving and improve the retirement prospects of future generations. These really aren’t tomorrow’s problems anymore.”

-Ends-

Notes

Phoenix Insights’ report ‘Tomorrow’s problem? Analysing the future impact of DC pension undersaving’ was undertaken with Frontier Economics. The analysis used the Phoenix Insights Longer Lives Index data (a survey of around 16,500 people across the UK aged 25 and over who are not yet retired) to forecast the trajectory of new retirees’ financial situations, providing a timeline for how the problem of undersaving may crystallise for new defined contribution retirees.

-

Phoenix Insights has developed the following five categories to determine whether they are on track for retirement based on the PLSA retirement living standards benchmarks:

-

The “financially struggling”:individuals expecting a retirement income below the PLSA minimum retirement living standard.

-

The “undersavers”: individuals expecting at least the PLSA’s minimum retirement income standard but not on track to achieve expectations according to our modelling.

-

The “downgraders”: individuals expecting at least the PLSA’s minimum income and on track to achieve it, but for whom this income would be insufficient to maintain their pre-retirement standard of living.

-

The “unsure”: individuals who were not able to provide an expected retirement income (many of whom may be disadvantaged by not engaging with pension decisions that will have significant consequences for their retirement).T

-

The “happily on track”: individuals expecting a retirement income above the minimum, on track to achieve it, and expecting it to maintain their living standards in retirement.

-

PLSA Retirement Living Standards